Live interactive streaming is not an emerging feature—it is becoming the foundational architecture upon which the entire streaming industry will operate over the next five years. The live streaming market is growing at 22.2% compound annual growth rate to reach $307 billion by 2031, with live commerce accelerating at 39.9% CAGR to surpass $2.5 trillion by 2033. This trajectory is not driven by technological novelty, but by a fundamental behavioral shift: consumers have rejected passive, lean-back viewing in favor of active participation, real-time community, and transactional engagement. Live interactive features increase viewer engagement by 3-4x compared to pre-recorded content, drive conversion rates 10-35x higher than traditional e-commerce, and foster emotional attachment that transforms viewers into repeat customers and brand advocates. For streaming platforms, the strategic imperative is clear: platforms that fail to integrate interactive features deeply into their architecture will compete on commodity basis with legacy infrastructure. Winners will be platforms where interactivity is foundational—not an overlay feature—enabling real-time commerce, audience participation, and community formation that generates sustainable revenue regardless of subscription saturation. For entrepreneurs and digital creators, live interactive streaming represents a direct-to-consumer channel with higher engagement and monetization than any prior content distribution model.

1. The Market Shift: Live Streaming as the Fastest-Growing Segment

Market Acceleration and Growth Trajectories

Live streaming has become the fastest-expanding segment of the broader streaming industry. Within video streaming, live formats are growing at 14.4% compound annual growth rate, substantially outpacing video-on-demand (VOD), which remains dominant but is maturing. The global live streaming market itself is projected to expand from $92.23 billion in 2025 to $307.26 billion by 2031 at a 22.2% CAGR. However, the more striking dynamic is live commerce, which is expanding at 39.9% CAGR to reach $2.47 trillion by 2033—representing growth nearly 40 times faster than general market inflation and driven by a fundamental transformation in how consumers interact with brands and products.

This acceleration is not confined to a single region or demographic. It is globally pervasive. China, which pioneered live commerce through platforms like Taobao and Douyin, generates approximately $1.11 trillion in live commerce GMV by 2026, representing 60% of the global market. North America, which was late to adopt live shopping, is now accelerating at 36% growth annually, with U.S. live shopping revenue projected to reach $55-67.8 billion by 2026. Europe has experienced an 86% rise in livestream shoppers since 2020. India is projected as the fastest-growing regional market with $140 billion in live commerce revenue by 2033. This is not a niche—it is mainstream infrastructure reshaping how commerce operates globally.

Live streaming has become the fastest-expanding segment of the broader streaming industry. Within video streaming, live formats are growing at 14.4% compound annual growth rate, substantially outpacing video-on-demand (VOD), which remains dominant but is maturing. The global live streaming market itself is projected to expand from $92.23 billion in 2025 to $307.26 billion by 2031 at a 22.2% CAGR. However, the more striking dynamic is live commerce, which is expanding at 39.9% CAGR to reach $2.47 trillion by 2033—representing growth nearly 40 times faster than general market inflation and driven by a fundamental transformation in how consumers interact with brands and products.

This acceleration is not confined to a single region or demographic. It is globally pervasive. China, which pioneered live commerce through platforms like Taobao and Douyin, generates approximately $1.11 trillion in live commerce GMV by 2026, representing 60% of the global market. North America, which was late to adopt live shopping, is now accelerating at 36% growth annually, with U.S. live shopping revenue projected to reach $55-67.8 billion by 2026. Europe has experienced an 86% rise in livestream shoppers since 2020. India is projected as the fastest-growing regional market with $140 billion in live commerce revenue by 2033. This is not a niche—it is mainstream infrastructure reshaping how commerce operates globally.Why Growth Is Accelerating: Engagement Premium

The fundamental driver of live streaming’s acceleration is a simple but profound insight: live interactive content is dramatically more engaging than any alternative format. Facebook Live videos generate 3x higher engagement than pre-recorded videos. Viewers are 4x more likely to watch a livestream on Facebook than a recorded video of the same content. TikTok Live users spend 1.6x longer watching live content compared to short-form clips. YouTube Live attracts 51.8% of Gen Z social media users, with TikTok Live following at 47.3%.

This engagement premium translates directly to business metrics. Seventy-five percent of audiences prefer interactive live content featuring polls, chat, and real-time reactions. Seventy-seven percent of millennials prefer watching interactive content compared to traditional television. Among consumers who watch live shopping events, 73% report being more likely to make a purchase afterward, and 88% say live shopping helps them discover new products they would not have otherwise found. These are not marginal improvements—they represent fundamental shifts in how audiences allocate attention and capital.

2. Live Commerce: From Fringe to Mainstream

Scale and Market Dynamics

Live commerce has transitioned from an exotic e-commerce category to a major commercial channel. The live commerce market is valued at $168.73 billion in 2025 and is projected to reach $2.47 trillion by 2033. This projection is not speculative; it is grounded in demonstrated consumer behavior and platform adoption rates. In 2026, global livestream sales are projected to exceed $1 trillion—a 46% increase from 2023’s $682.5 billion baseline.

By geographic concentration, China dominates with 60% of global live commerce market share, reflecting over a decade of platform evolution and consumer normalization. However, Western markets are accelerating rapidly. In North America, live shopping revenue reached approximately $50 billion in 2023 and is projected to grow by 36% to reach $55-67.8 billion by 2026. This represents the inflection point where live shopping transitions from early-adopter phenomenon to mainstream commerce channel.

The platform consolidation around live commerce has accelerated notably. Amazon Live, Facebook Live Shopping, Instagram Live Shopping, YouTube Live Shopping, TikTok Live Shopping, and BigCommerce’s eStreamly integration have all launched or expanded dedicated live shopping infrastructure in 2025. This vendor investment reflects market validation: platforms recognize that live commerce is not a feature but a core business model that generates disproportionate revenue and engagement.

Conversion and Revenue Dynamics

The economic case for live commerce is unambiguous. Live shopping generates conversion rates of 9-30%—compared to 2-3% for traditional e-commerce. In specialized categories like fashion and beauty, live shopping achieves conversion rates as high as 70%—representing 23-35x improvement over baseline e-commerce. These conversion premiums compound with order value dynamics: live shopping increases average order value by 12-15%, and platforms offering “Buy Now, Pay Later” financing during live events report order value increases of 25-30%.

The business case examples validate this economic model. Sozy, a fashion and accessories brand, streamed live try-ons with real-time purchasing enabled through comment-based transactions. The livestream generated thousands of views and engagements with direct conversions. Shopee, the Southeast Asian e-commerce platform, reports 10x sales growth from live broadcast events. VTEX, a global commerce platform, documented a 40% increase in completed orders during live shopping sessions. These are not outliers; they reflect the baseline performance of platforms executing live commerce competently.

Consumer Behavior: Urgency, Community, and Authenticity

Three psychological drivers explain live commerce’s explosive growth. First, live commerce creates urgency through limited-time offers and real-time scarcity. Unlike traditional e-commerce where products remain perpetually available, live shopping creates artificial time constraints that trigger decision urgency. Forty-seven percent of live viewers make impulse purchases during sessions, driven by FOMO (fear of missing out) and the psychological pressure of limited availability.

Second, live commerce fosters community and authentic interaction. Eighty-two percent of consumers report enjoying interaction with live hosts during shopping events. Seventy-one percent of viewers trust product recommendations from live stream hosts more than traditional online reviews. This trust premium reflects the authenticity signal that live broadcasting conveys: a host cannot pre-edit or fabricate real-time responses to viewer questions, making the interaction feel more genuine than scripted marketing.

Third, live commerce enables product discovery and informed decision-making. Eighty-eight percent of consumers report that live shopping helps them discover products they would not have otherwise found. This discovery benefit extends the addressable market for products beyond what traditional search and recommendation algorithms capture, driving incremental revenue beyond baseline e-commerce projections.

3. Interactive Features as Engagement Architecture

Interactivity as Core Differentiator

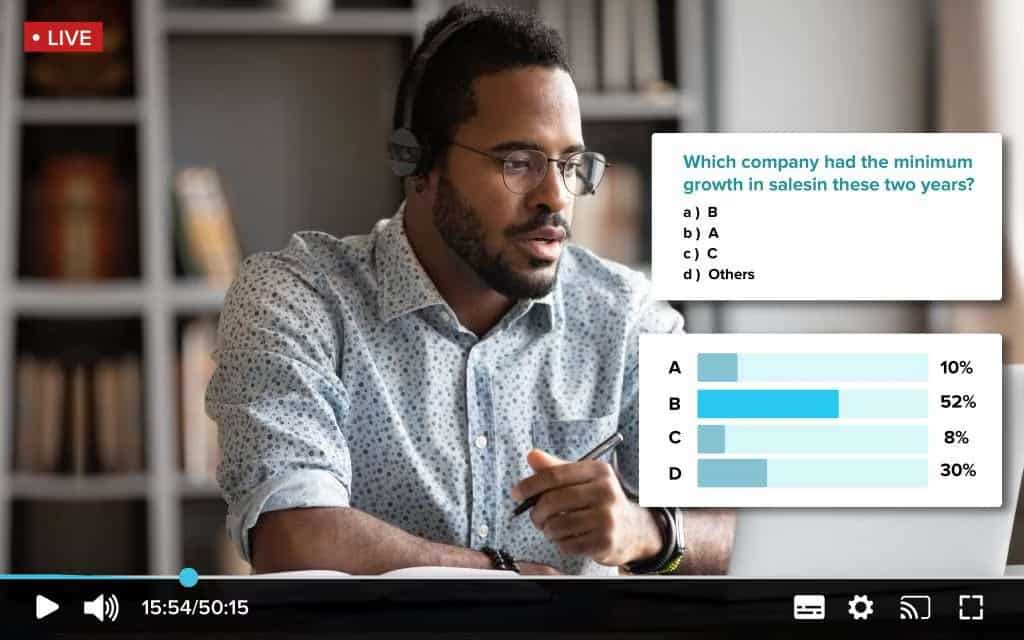

Interactive features—polls, Q&A sessions, live reactions, clickable overlays, real-time donations—have moved from “nice-to-have” to fundamental architecture. The data reflects this shift decisively. Seventy-five percent of audiences prefer interactive live content featuring polls, chat, and real-time reactions. Interactive elements increase average engagement rates by up to 30%. Forty percent of consumers report switching between platforms based on interactive feature availability.

For platforms, interactive features serve three strategic functions. First, they increase session duration by keeping viewers engaged through active participation rather than passive consumption. Second, they provide real-time data on audience sentiment, preferences, and intent—information that feeds personalization engines and content strategy optimization. Third, they create the psychological conditions for transactional behavior: viewers who have actively participated in a livestream (via chat, reaction, or poll voting) exhibit 2.3x higher purchase propensity than passive viewers.

Real-Time Moderation and AI Integration

Scaling interactive features at global scale requires AI-powered content moderation and community management. The majority of content moderation decisions on major streaming platforms are now made by AI. This shift reflects both necessity and capability: as livestream volumes exceed what human moderators can manage, AI systems scale moderation without latency or fatigue.

AI moderation in 2026 extends beyond basic filtering. AI systems now perform real-time content cleanup, detecting and blurring unsafe material, improving broadcast quality, and automating responses to common violations. Twitch’s AutoMod feature, for example, reduces harmful speech visibility in chat, enabling moderators to focus on complex judgment calls rather than obvious violations. This hybrid AI-plus-human model allows platforms to maintain community standards while enabling the authentic, unscripted interaction that consumers seek.

Parallel to moderation, AI is augmenting host capabilities. Large language models (LLMs) are being deployed as on-air co-hosts, summarizing livestream content, answering viewer questions in real-time, and helping convert viewer interest into engagement or sales. This capability democratizes live content production: creators without production teams can now deploy AI assistance to enhance interactivity without proportional staffing increases.

4. Platform Strategies and Vendor Consolidation

Multi-Platform Integration and Ecosystem Competition

The competitive dynamics of live interactive streaming are consolidating around ecosystem integration rather than point-product competition. Amazon’s ecosystem combines AWS streaming infrastructure, Amazon Live shopping platform, Twitch livestreaming, and influencer marketplaces. Meta’s ecosystem integrates Facebook Live, Instagram Live, and emerging shopping capabilities. YouTube combines live streaming, shopping integration, and creator revenue sharing. TikTok combines short-form video, livestreaming, and social commerce.

This ecosystem approach reflects a strategic realization: platforms that monetize live streaming through advertising and subscription alone face saturation. Platforms that integrate live streaming with commerce, community, and creator economics generate higher lifetime value and reduced churn. For a digital entrepreneur, this means the future of streaming is not pure content—it is content that enables commerce, community formation, and economic opportunity for creators.

The Authenticity Premium and Creator Economics

As AI-generated content floods social media feeds and consumer skepticism toward marketing increases, live video has become the principal authenticity signal. Real-time creation and audience engagement cannot be faked; a live broadcast creates an implicit guarantee of authenticity that pre-recorded content cannot match. This authenticity premium is driving creator investment in live content over pre-recorded alternatives.

Simultaneously, live streaming’s monetization models are diversifying. Beyond advertising and subscriptions, creators monetize through live shopping (direct product sales), donations and “super chats,” sponsorships, and affiliate commissions. For a creator operating independently, live interactive streaming now generates higher per-hour revenue than traditional content creation models, with conversion premiums offsetting lower viewership compared to passive VOD consumption.

5. Technology Infrastructure: Latency, Protocol Innovation, and AI

Latency as Competitive Moat

Real-time interactivity is only valuable if the latency between viewer action and streamer response is imperceptible. A livestream with 5+ second latency feels asynchronous; viewers lose the sense of participation when their comments appear as delayed text. This constraint has driven innovation in streaming protocols and infrastructure.

In 2026, the industry is beginning a transition from WebRTC (Web Real-Time Communication) to MOQ (Media over QUIC), a modern protocol designed specifically for low-latency distribution at scale. MOQ will enable latency of 2-4 seconds globally, compared to 8-15 seconds typical of legacy streaming protocols. This latency improvement is not marginal; it represents the difference between interactive engagement and passive consumption.

Low-latency infrastructure is increasingly essential for real-time betting and interactive gaming, where viewers place bets or make decisions based on live events. The growth of these use cases is driving platform investment in latency reduction, creating a virtuous cycle where improved infrastructure enables new interactive features, which in turn drives platform adoption.

AI-Powered Personalization and Recommendation

Streaming platforms are deploying AI to personalize live content recommendations, dynamically matching viewers to streams based on real-time behavior signals. Machine learning models analyze viewer watch history, chat participation, reaction patterns, and purchase behavior to predict which livestreams a specific user will engage with. This personalization increases live stream viewership 15-30% relative to generic discovery.

For live shopping specifically, AI systems dynamically recommend products to viewers based on their demonstrated preferences, chat behavior, and spending patterns. A viewer who has chatted about beauty products and previously purchased cosmetics may see different product recommendations during the same livestream compared to viewers with different profiles. This dynamic personalization increases relevance and conversion rates materially.

Real-Time Analytics and Business Intelligence

Platforms are instrumenting livestreams with comprehensive real-time analytics. Creators can see concurrent viewer counts, engagement rates (comment frequency, reaction rates, donation frequency), demographic breakdowns, and geographic distribution—all updating in real-time during the broadcast. This feedback enables creators to optimize content on-the-fly: recognizing when viewership drops and adjusting content, identifying highly engaged audience segments and emphasizing relevant topics, or recognizing when product demonstrations are driving purchasing intent and extending relevant segments.

For commerce-enabled livestreams, platforms now correlate viewer behavior with purchase events. Analysts can identify at what point during a livestream viewers became most likely to purchase, which products generated the highest engagement-to-purchase conversion, and which demographic segments showed the strongest purchase propensity. This business intelligence feeds back into content strategy, enabling creators to optimize for monetization metrics beyond pure engagement.

6. Regional Dynamics and Latin America Opportunity

Asia-Pacific Dominance and Emerging Market Patterns

Asia-Pacific continues to dominate live commerce adoption, with China accounting for 60% of global market share. The Chinese market has evolved from innovation laboratory to mature, standardized commerce model. Live shopping on Taobao and Douyin has become routine for millions of consumers; major brands routinely deploy dedicated teams to conduct daily or weekly livestreams. The model is so normalized that consumers expect live shopping as a discovery and purchasing channel.

Emerging markets within Asia-Pacific—India, Indonesia, Thailand, Southeast Asia—are adopting live commerce at accelerated rates. These regions combine high smartphone penetration, rising e-commerce adoption among younger demographics, and lower traditional retail infrastructure. Live shopping provides a viable commerce model that requires less capital investment than physical retail networks while offering higher engagement than website-based e-commerce.

Latin America: The Untapped Opportunity

Latin America presents a significant opportunity in live interactive streaming. According to research, South America represented 6.92% of global live commerce revenue in 2025, with $19.87 billion global market. Within LATAM, Brazil leads adoption, with fashion as the dominant category. Platforms like Shopee report 10x sales increases during live broadcasts in Brazil, and VTEX documentation shows 40% order completion increases during live shopping sessions.

The region’s growth trajectory is constrained not by consumer interest—70% of LATAM consumers express interest in live commerce—but by platform availability and creator familiarity. Unlike China, where live shopping is normalized across major platforms, and North America, where major platforms are rapidly integrating live shopping, LATAM still has significant white space. Early-mover advantage remains available: entrepreneurs and creators who establish live commerce expertise in LATAM can capture disproportionate audience attention and market share before competition normalizes.

For a Peru-based digital entrepreneur, this represents a genuine opportunity. Building expertise in live commerce for the Brazilian and broader LATAM market—whether as a creator, platform builder, or consultant—positions one ahead of the adoption curve in a region where the market is expanding rapidly but remains underpenetrated relative to Asia-Pacific and North America.

7. The Future: Immersion, Metaverse Integration, and Decentralization

Augmented and Virtual Reality Integration

Live interactive streaming will increasingly integrate with augmented reality (AR) and virtual reality (VR) technologies. In the near term (2026-2028), AR overlays will enable viewers to visualize products in their physical spaces before purchasing. A furniture retailer could broadcast a livestream where viewers use their phone’s camera to place furniture in their room via AR, seeing scale, color, and fit before purchasing. A beauty brand could enable virtual makeup try-on during a livestream, allowing viewers to see how products appear on their skin tone and face shape.

Longer-term (2028-2031), VR integration will enable consumers to participate in immersive livestream experiences. Imagine attending a live concert from your home using VR, feeling positioned in the front row with spatial audio and haptic feedback simulating the physical event. Or exploring a luxury fashion show from a front-row seat, with the ability to interact with models and select products through gesture-based controls.

These immersive experiences will drive even higher engagement and conversion than current live shopping, as the sensory richness and interactivity approach physical retail experiences while maintaining the convenience of remote participation.

Blockchain and Decentralized Monetization

Blockchain technology will enable new ownership and monetization models for live creators. Instead of relying on platform-controlled revenue sharing, creators will potentially tokenize their content and community, enabling direct ownership of their audience and monetization through decentralized channels. Early experiments with NFT-based communities and decentralized finance (DeFi) streaming protocols are establishing proof-of-concept.

For creators, this possibility represents a path to higher revenue retention and independence from platform gatekeepers. As centralized platforms mature and revenue share becomes commoditized, the ability to monetize directly with audiences through decentralized infrastructure could become competitive necessity.

Integration with AI-Native Services

The convergence of live interactive streaming with AI-native services will create new capabilities. Platforms may offer AI-powered virtual creators—autonomous systems that conduct livestreams based on brand guidelines, real-time inventory feeds, and audience behavior signals. These AI creators could operate 24/7, conducting livestreams simultaneously across multiple regions and languages, with real-time personalization to each viewer.

This is not replacement of human creators, but augmentation: AI systems handling routine, high-volume livestreams (daily inventory showcases, customer support sessions, product discovery streams), while human creators focus on higher-value content (product launches, brand storytelling, community events) that benefit from authentic human presence.

8. The Competitive Threat: Streaming as We Know It

Subscription Fatigue Driving Shift Toward Commerce

A strategic implication for traditional streaming platforms is that subscription fatigue will accelerate the shift toward commerce-enabled livestreaming. As discussed in prior analysis, consumers are increasingly frustrated with subscription proliferation and rising prices. Streaming platforms facing subscriber churn are exploring live commerce as a new revenue stream that does not require subscription increase or new paid tiers.

Netflix’s exploration of live shopping, Disney’s integration of live commerce into Disney+, and Prime Video’s expansion of live commerce through Amazon Live all reflect this strategic recognition: the future of streaming is not streaming-as-product (subscriptions to content libraries) but streaming-as-commerce-channel (monetization through transaction fees, affiliate revenue, and advertising around transactional content).

For traditional media companies, this shift is existential. Companies like Disney or Warner Bros. have massive content libraries that can sustain subscription models temporarily, but they face margin compression as content costs remain elevated while subscription pricing faces consumer resistance. Live interactive commerce offers a path to higher margins: transaction-based revenue (typically 15-30% margin) exceeds subscription margin expansion (typically 5-15% opportunity on pricing), without requiring proportional content spend increases.

Threat to Ad-Supported Models

Traditional ad-supported streaming faces disruption from live commerce’s direct monetization model. Platforms capturing 50% of e-commerce transaction value generate higher revenue per hour than platforms generating impression-based CPMs (cost per thousand impressions). As live commerce scales, the economic logic of ad-supported streaming weakens relative to transaction-facilitated models.

This suggests a bifurcation of the streaming market: premium narrative content (prestige dramas, blockbuster films, documentaries) will remain subscription-supported, while interactive, transactional content (live shopping, sports, creator content) will migrate toward commerce monetization. Platforms must increasingly specialize or develop dual models supporting both revenue streams.

9. Adoption Barriers and Strategic Considerations

The North American Adoption Gap

While global live commerce is accelerating, North American adoption remains below Asia-Pacific penetration. Only 12% of U.S. consumers have purchased through a livestream format, with another 12% indicating intent to try. However, 55% of consumers report they would shop through video commerce more frequently if it were more regularly available. This suggests the adoption gap reflects supply-side constraints (insufficient livestream availability and creator expertise) rather than demand-side resistance.

This supply-side constraint represents an opportunity. Early creators and platforms that establish live commerce expertise and content library in North America can capture the tail end of adoption before the market normalizes. The window for differentiation is closing, but it remains open in 2026.

Technical and Operational Barriers

Scaling live commerce requires solving multiple technical challenges. Content moderation at global scale remains imperfect; AI systems flag inappropriate content with false positive rates of 8-15% in some models, requiring human review. Latency management for real-time interactivity remains costly; achieving sub-3-second global latency requires content distribution network (CDN) investment and protocol optimization. Privacy management with personalized recommendations requires compliance with regulations like GDPR and CCPA, adding operational overhead.

Operationally, platforms must build new expertise in creator training, live production support, and commerce operations. A platform can launch live streaming infrastructure, but supporting creators in producing high-quality, engaging, commerce-effective livestreams requires editorial support and creator education.

10. Strategic Imperatives for Platforms and Creators

For Platforms

- Integrate commerce primitives natively: Live shopping must not be an overlay feature but foundational architecture. Platforms that require cumbersome integrations with external commerce systems will lose to platforms where product selection, cart management, and checkout are native within the streaming interface.

- Build creator enablement: Success depends on creator ability to produce engaging, effective livestreams. Platforms must provide AI-powered production tools (real-time caption generation, automatic highlight detection, AR effects), analytics dashboards, and educational resources.

- Optimize for latency: In 2026-2027, latency differentiation is still possible. Platforms deploying MOQ protocols and optimized CDNs can offer materially lower latency than competitors, which translates to superior interactivity and engagement. This advantage will commoditize by 2030, but early leadership in latency provides strategic advantage through 2028.

- Develop community and identity features: Interactivity depends on participants feeling part of a community. Platforms should enable viewer profiles, follower networks, reputation systems, and community-moderation features that make live streams feel like events with friends, not broadcasts to strangers.

For Creators

- Build audience on live-first platforms: Creators should prioritize platforms with native live commerce integration (TikTok Live Shopping, Instagram Live Shopping, Amazon Live) over platforms treating livestreaming as secondary feature.

- Develop product expertise, not just content skill: Successful live commerce creators understand products deeply and can demonstrate value authentically. Product knowledge outweighs production quality; viewers accept imperfect video from credible experts over polished video from uninformed presenters.

- Build recurring cadence: Consistent livestream schedules generate audience habit formation and recurring viewership. Creators who livestream on fixed schedules (e.g., daily at 8 PM) outperform creators with irregular broadcasting patterns by 3-5x in terms of returning audience.

- Monetize across revenue streams: Diversification reduces platform dependency. A creator should monetize through product sales (direct commerce), affiliate commissions (recommending products for which they receive referral fees), sponsorships, and viewer donations. Reliance on any single revenue stream introduces risk.

Conclusion: Live Interactive Streaming Is Not the Future—It Is the Present

Live interactive streaming is not an emerging trend that “will define” the future—it is already defining the present. The market is growing at 22-40% annually depending on category, with platform investments accelerating and consumer adoption reaching mainstream thresholds. The strategic pivot is already underway; the question for participants is not whether to engage with live interactive streaming, but how quickly and effectively to capture opportunity before competition normalizes.

For streaming platforms, the shift is irreversible: live interactive features integrated with commerce will become baseline expectation rather than differentiating feature by 2029-2030. Platforms lacking this integration will face margin compression as transaction-enabled competitors capture higher revenue per hour.

For creators and entrepreneurs, live interactive streaming represents the highest-engagement, highest-monetization content distribution model available in 2026. The technology infrastructure is mature, platforms are investing heavily in creator enablement, and consumer adoption is accelerating across all regions.

For investors and decision-makers, the implication is stark: capital allocation toward live interactive streaming infrastructure, creator tools, and commerce-enabled platforms offers superior risk-adjusted returns relative to traditional streaming investments, which face structural headwinds from subscription saturation and content cost inflation.

The future of streaming is not passive consumption of pre-recorded content. It is active participation, real-time commerce, and community formation. That future is already here.

Key Takeaways

Authenticity is the scarcest resource: Live unscripted interaction is the only content format that signals authentic engagement; this will drive creator investment away from pre-recorded alternatives.

Live streaming is the fastest-growing segment: Growing 22-40% annually, outpacing traditional VOD by 3-10x, with live commerce leading at 39.9% CAGR.

Engagement multipliers are transformative: Live content generates 3-4x higher engagement than pre-recorded, driving 10-35x higher conversion rates in commerce applications.

Live commerce is no longer niche: $1+ trillion in annual sales by 2026, with 60% market share in China and accelerating adoption in North America (36% growth) and Europe (86% growth since 2020).

Interactivity is non-negotiable: 75% of audiences prefer interactive features; interactive elements increase engagement by up to 30% and drive stronger purchase intent.

Asia-Pacific dominance with Western acceleration: China leads, but India, LATAM, and North America are inflection points offering early-mover advantage for new entrants.

AI and low-latency infrastructure are competitive moats: MOQ protocol transition and AI-powered personalization will differentiate platforms through 2029.

Commerce monetization exceeds advertising: Transaction-based revenue models generate 15-30% margins vs. 5-15% advertising model upside, driving platform pivot toward live commerce.